Locate the Perfect Financing Providers to Fulfill Your Monetary Goals

In today's intricate financial landscape, the quest to find the best loan services that align with your special financial objectives can be a challenging job. With countless alternatives offered, it is important to navigate with this maze with a critical method that guarantees you make informed choices (Loan Service). From understanding your economic needs to examining lender track record, each step in this procedure needs careful factor to consider to secure the best feasible result. By following a systematic approach and considering all elements at play, you can place yourself for economic success.

Evaluating Your Financial Demands

When taking into consideration financing solutions for your monetary goals, the initial action is to extensively examine your present financial needs. Begin by evaluating the specific objective for which you need the car loan.

Additionally, it is vital to perform a comprehensive review of your current financial situation. Consider factors such as your credit rating score, existing debts, and any upcoming expenditures that might affect your capability to pay off the financing.

In enhancement to comprehending your monetary needs, it is advisable to research and contrast the financing choices offered out there. Different fundings featured varying terms, rate of interest, and payment schedules. By thoroughly evaluating your requirements, economic setting, and available lending items, you can make an educated decision that sustains your monetary goals.

Comprehending Lending Alternatives

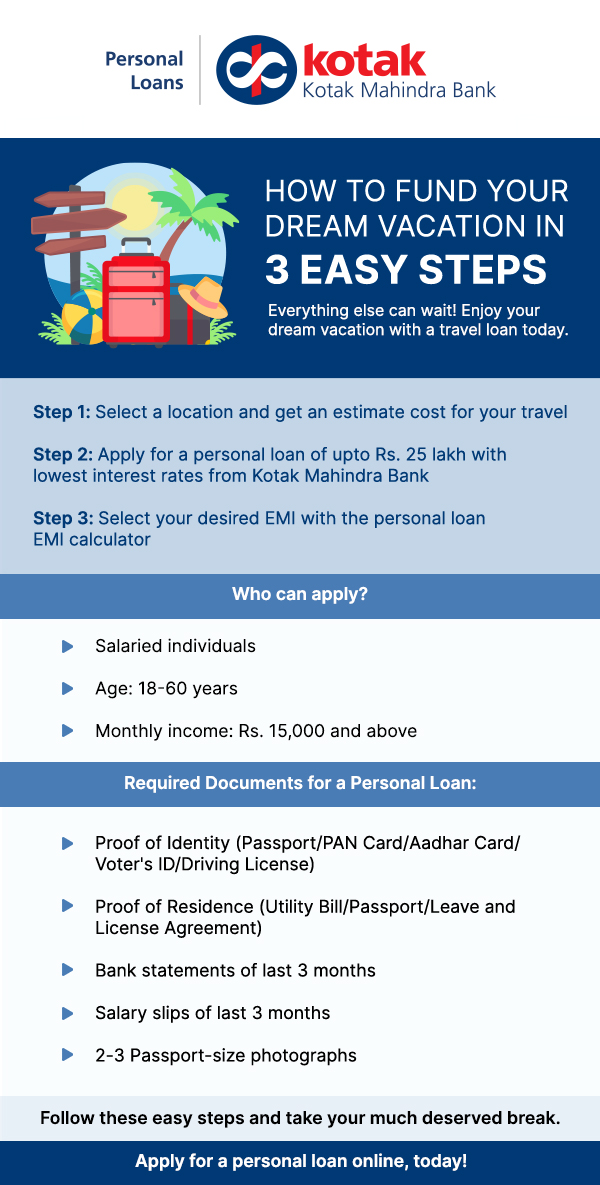

Checking out the array of lending options readily available in the financial market is necessary for making educated choices lined up with your certain demands and objectives. Comprehending loan alternatives includes familiarizing yourself with the different kinds of fundings offered by financial institutions. These can range from traditional options like personal lendings, mortgages, and automobile financings to extra customized items such as home equity finances, cash advance, and pupil finances.

Each kind of car loan includes its very own terms, problems, and payment frameworks (business cash advance lenders). Individual finances, for example, are unsafe finances that can be utilized for numerous functions, while mortgages are safeguarded fundings specifically created for acquiring property. Vehicle fundings cater to funding vehicle acquisitions, and home equity lendings permit property owners to obtain against the equity in their homes

Contrasting Rate Of Interest and Terms

To make informed choices concerning car loan options, an essential step is contrasting rate of interest rates and terms supplied by economic organizations. Understanding and contrasting these terms can assist borrowers pick the most appropriate loan for their economic circumstance. Additionally, analyze the effect of lending terms on your economic goals, ensuring that the picked funding aligns with your budget plan and long-term purposes.

Assessing Lending Institution Credibility

In addition, take into consideration getting in touch with governing bodies or economic authorities to make certain the lending institution is accredited and compliant with industry policies. A trustworthy lender will certainly have a strong track document of honest financing practices and clear communication with borrowers. It is additionally valuable to look for recommendations from pals, household, or economic experts that might have experience with trustworthy lending institutions.

Ultimately, picking a lending institution with a strong reputation can offer you peace of mind and self-confidence in your loaning decision (merchant cash advance loan same day funding). By conducting extensive study and due persistance, you can pick a lender that aligns with your financial objectives and values, setting you up for a successful borrowing experience

Choosing the Finest Financing for You

Having completely evaluated a lender's track record, the next crucial action is to thoroughly pick the finest loan alternative that aligns with your financial goals and demands. When selecting a lending, take into consideration the purpose of the loan.

Contrast the interest rates, finance terms, and costs provided by different lending institutions. Reduced rates of interest can save you cash over the life of the funding, while favorable terms can make payment extra manageable. Consider any kind of additional expenses like source fees, early repayment fines, or insurance coverage demands.

Additionally, focus on the payment timetable. Choose a funding with month-to-month payments that fit your budget plan and duration for settlement. Adaptability in repayment options can likewise be helpful in situation of unexpected financial modifications. Eventually, choose a financing that not only meets your current financial requirements however likewise sustains your long-lasting monetary objectives.

Verdict

To conclude, locating the best finance solutions to satisfy your monetary goals requires a comprehensive assessment of your financial demands, recognizing finance choices, comparing interest prices and terms, and examining loan provider credibility. By carefully taking into consideration these aspects, you can choose the most effective lending for your specific scenario. It is very important to prioritize your financial purposes and select a lending that straightens with your long-lasting financial objectives.

Comments on “Unlock Your Potential with Professional Loan Services”